Dave Amber Clear Tide Limited

Role: Adviser / Consultant / Coach, Chairman, Chief Restructuring Officer, Non Executive Director

ABOUT MEMBER

Dave is an investment banker, turned NED, turned CEO, turned consultant. He started his career with NatWest/RBS in relationship banking, then Credit, moving into Leveraged Finance in 1996 as a deal-doer, backing many PE-backed MBO’s/LBO’s before moving across to the post-deal portfolio monitoring side in 2000. Since 2001, Dave has spent most of his time on small-mid-cap highly leveraged, stressed/distressed deals across UK, Europe and USA, where he initially represented RBS’ Mezzanine Fund (as Board Observer) to protect/enhance/recover value, working with executive boards and PE sponsors to deliver better solutions across a wide range of sectors including retail, leisure, manufacturing, automotive, printing and service businesses. He has undertaken a large number of Board Observer roles and lead restructures.

In 2008 he was headhunted into Landsbanki (now LBI), the Icelandic bank to run their Leveraged loan book, shortly prior to the bank’s collapse in Oct 2008 – this resulted in a multitude of restructuring activity (financial and operational) led by Dave where the bank had the equity economics either directly or through the debt. This sometimes involved taking direct board appointments, most notably Aurum Holdings Ltd (Watches of Switzerland/Mappin & Webb/Goldsmiths) [NED] and VCG (Holdings) Ltd [NED and later Joint CEO]. Dave delivered some outstanding recoveries and value-enhancements for LBI’s creditors (Aurum won Turnaround of the Year 2013 at the IFT).

More recently (Feb-2015-Jan 2017), Dave took on the Joint CEO role of VCG (a brand management and graphics group) where a 2-year turnaround delivered a successful exit/sale in January 2017 at a strong multiple.

Since then he has taken NED, board support and consulting roles for a variety of PE-backed and lender-owned businesses using his 25 years in the PE/Leveraged Finance industry to help recover and build value. He currently sits on the Holdco board of Fat Face, the lifestyle brand retailer as a Non-Executive Independant Investor Director for a large Direct Lending Fund.

Dave is available in many capacities (NED/chair/consultant/advisor/Portfolio Management) and looking for additional role(s) to add to his portfolio.

Organisation Type

- Family/Private

- Institution Backed

- Private Equity Backed

Average Company Size (£Million)

- > 5

- > 25

- > 100

- > 250

AVERAGE ASSIGNMENT LENGTH (MONTHS)

- 1 - 24

PREFERRED ASSIGNMENT LENGTH (MONTHS)

- 3 - 24

Sector*

- Automotive

- Manufacturing

- Business Services

- Consumer Goods & Retail

- Financial Services

- Food & Beverages

- Leisure

- Manufacturing

- Services

- Technology & Telecoms

- Transport & Logistics

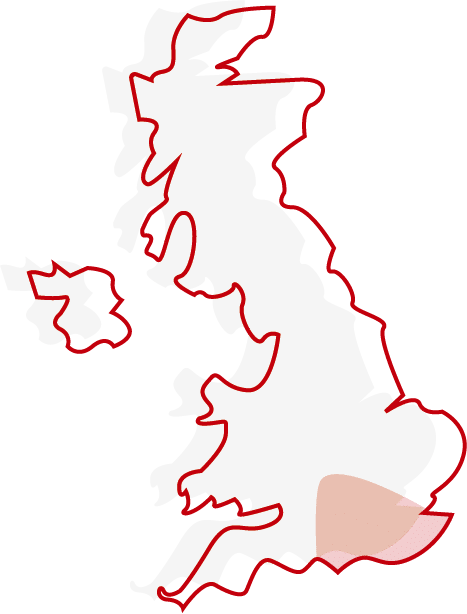

MEMBER WORK REGION

London & South