Susan Moor, Director of FRP Transition, reviews the current state of play in the interim market, and provides her insight on what the future may hold as we move further out of lockdown.

It goes without saying that for many sectors, the implications of lockdown in the long-term are still unclear. As the situation has progressed and we have begun to gain more clarity since those first initial weeks of uncertainty, clear strengths and limitations have emerged as some industries fare far better – or worse – than others.

Encouragingly, we are working with a number of new government aid schemes and policy changes that are designed to stabilise and stimulate the economy.

It’s similarly encouraging to see that according to the Institute of Interim Management’s (IIM) latest survey, half of all interim managers who had a role at the time of lockdown kept their contracts. However, there was a clear divergence in terms of the scope of that role, and an emerging pressure on them to lower their daily rate.

The IIM suggests that on the whole, a fifth (20%) of all interims had their roles terminated immediately, as some projects were put on pause across many sectors and business sizes. The survey also reported that interim providers saw a 60% drop in the number of roles available and in the Midlands, however according to interim agency Greenwell Gleeson, this was closer to 70%, due to the dominance of the highly impacted automotive and aerospace sectors in the region.

Another influencing factor that many firms reported experiencing was a concern about how appointing an external, paid expert may be interpreted, particularly when many of the business’ employees were enrolled on the government’s furlough scheme.

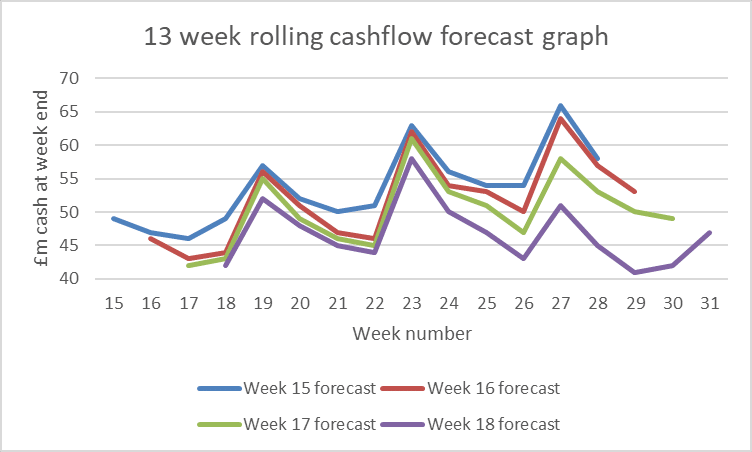

The interims that we have spoken to are going above and beyond to support their local business communities or ex-clients. This support has included completing the requisite information applications for government support, making sure cashflow forecasts and business plans offer a sensible track back to normality, and ensuring and offering reassurance that payments will be met.

Remarkably, it is touching to see that much of this work appears to have been done at discount or even entirely pro bono.

The interim assignments taken on during lockdown have been of business-critical importance rather than just a request for remote help. The roles have not necessarily been related to Covid-19 but to external factors, such as fraud, dismantling a joint venture (JV) or maintaining a long-planned Systems Applications and Products (SAP) rollout. Turnaround and restructuring roles have not come to the fore as yet, though it is suspected we might see those appearing later on in the last quarter and the first quarter of 2021.

Looking back over the past 12 months, the biggest change in the market has been the origination of interim introductions. In a move away from the traditional avenues of introduction through bank support and instead towards commercial discounters and private equity funds.

So, what does the future hold for the independent interim? Putting aside the historically quieter month of August, and looking ahead at September, we expect we will start to see interim assignments being brought back to life, with shareholders and investors waking up to the issues caused by the circumstances of the past six months.

We can see this manifesting itself firstly in the finance functions, and if they can be stabilised, then operational roles will follow, as businesses begin to change their operating models as they move forwards and adapt to thrive in the new normal we are building around us.

Private equity, distressed and mainstream funds are gearing up for acquisitions to buy or ‘bolt-on’ assets – either capitalising on insolvencies, attractive valuations or the opportunity to create scale. This could mean the creation of more operational and financial due diligence roles, followed by the subsequent introduction of integration and/or further turnaround roles.

This is a tough environment for business all over the world, however we should be encouraged by the signs that the market is coming back, albeit hindered somewhat by a cautiously slower pace of decision-making.

With perseverance and a more brave and forward-thinking approach, we can continue to weather this storm and rebuild for a future with a new perspective on business, restructuring, and the role of the interim manager.

About FRP

http://www.frpadvisory.com

FRP Advisory Trading Limited, which is a whole owned subsidiary of FRP Advisory Group plc, provides a professional and considered approach to problem solving. With 56 partners and more than 380 staff operating from 18 offices across England and Scotland, FRP is one of the UK’s largest independent business advisory firms specialising in corporate restructuring, corporate finance, forensic services, pensions advisory and debt advisory. It has a strong reputation and track record for creating, preserving, and recovering value across a range of complex situations. Its advisers work at board level, with investors, lenders, government and regulatory bodies, plus other professionals and individuals requiring professional support. FRP provides a wide range of services, as well as specialist industry experience to enable the delivery of sector specific solutions.

Contact

Created on behalf of FRP by Citypress.

For more information please contact:

Calum Anderson

Calum.anderson@citypress.co.uk

M: +44 (0)131 460 7922