The impact of coronavirus is already exacerbating existing challenges for businesses in the UK. In the context of increased strain, we are sharing the key turnaround insights as you implement measures in your business to deal with coronavirus.

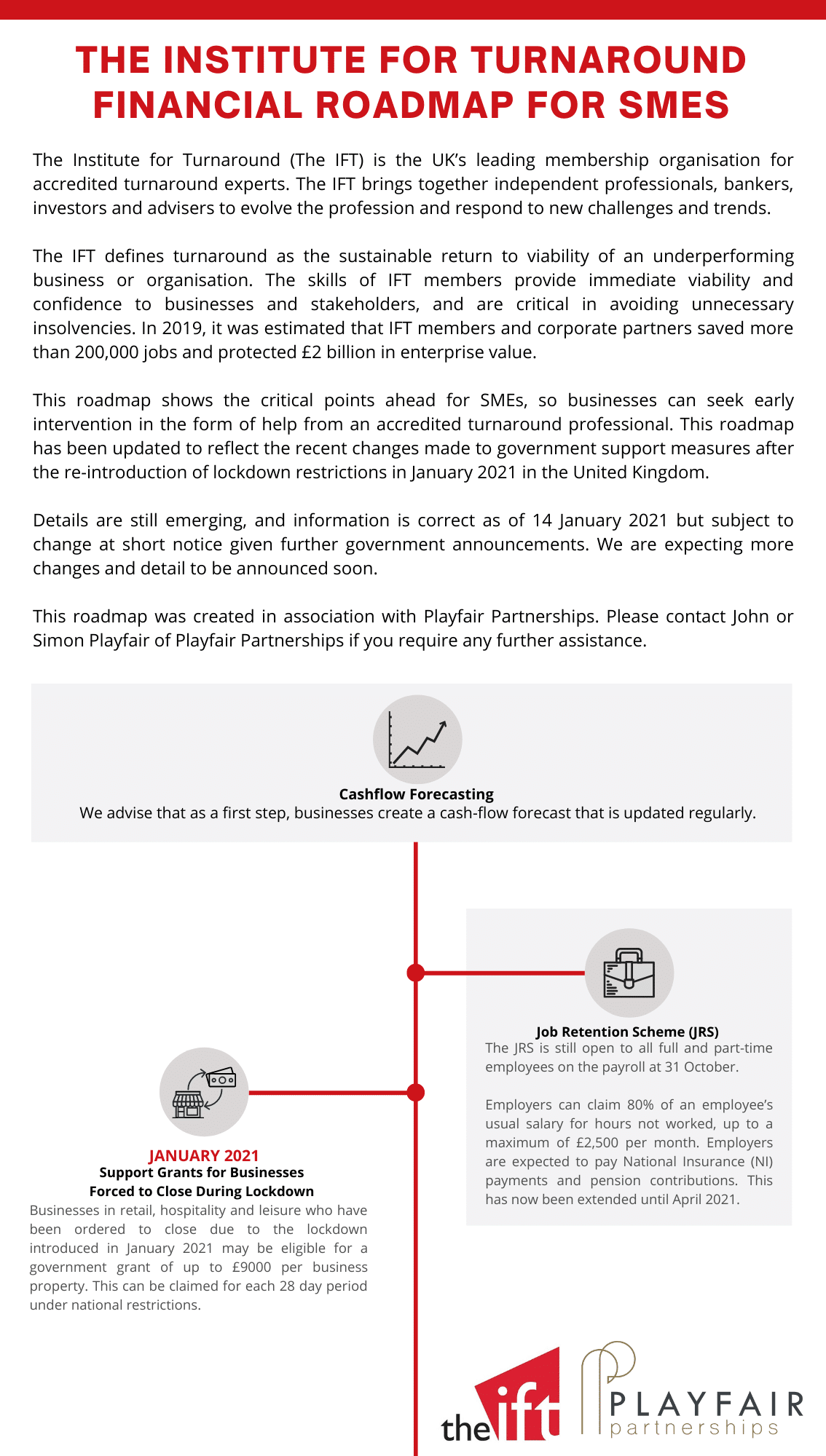

Knowledge and Planning

Understand your position and keep doing so, to aid your planning and management and to help your stakeholders have confidence, “a well-constructed forward looking report focusing on the key KPIs: sales, orders, cash, debts and profit will help with decision making and any difficult conversations. Management should be thinking about actions they can take to mitigate shortfalls and pinch points in the short-term cash flow”, says Ian Parker, Independent Turnaround Professional.

Once you have this forward-looking view, it is important to also ensure it is agile to deal with rapidly changing circumstances:

“It’s important to identify the planning assumption with the greatest uncertainty around them and then develop multiple scenarios for each. This won’t give you a ‘crystal ball’ but it will greatly increase the resilience of your plans.”, adds Kelly Jones, IFT corporate partner Kingsgate.

Stakeholder confidence

Trust levels can naturally become affected at times of stress. Identify and manage stakeholder expectations – lenders, funders, shareholders, customers, suppliers and your workforce. Engage early and consistently to ensure confidence and trust.

In addition to providing the basis for contingency planning, trusted information and trusted relationships go hand in hand:

“Open and honest discussions should be had as early as possible. It’s generally in lenders’ interests to be supportive, but they will need to have confidence in the management information and the management team.” says Philip Watkins, Restructuring Advisory Partner, FRP.

It is essential that the leadership grasps the issues and motivation from the top to the bottom of the business. From engagement in hygiene measures to steps you may need to take to temporarily remodel or scale back operations, your colleagues need to know how they can get involved and how they will be affected.

Cash Flow

“The life blood of any business is cash. Take a long hard look at your regular and discretionary expenditure”, says Ian Parker. Running out of cash is often the trigger point for a crisis. Fixing the finances is not a cure in itself, but it does provide the time and space to manage wider issues.

Cash collection remains crucial whilst recognising that customers and suppliers will likely be facing similar challenges. “It is even more essential in these testing times that robust cashflow forecasting is in place”, says Nina Warwick, Independent Turnaround Professional.

Supply Chain Disruption

A key part of your contingency planning will be managing your supply chains, including clarity on where essential materials and components come from: “Large multi-nationals supplying key components may have multiple facilities, but key components can cause serious disruption”; local suppliers are important too and have different issues “this group is usually under-capitalised and reliant on short term finance and overdrafts” however, the government’s recent measures to refund 14 days sick pay for SMEs with fewer than 250 employees will ease cash flow for some suppliers.

Adapting your Operating Model

Every business will be considering how to do things differently, but many businesses cannot use home working as an option. The need for reduced working may coincide with staff illness and isolation, and businesses should be making maximum use of government measures, such as refunding sick pay for businesses with fewer than 250 employees. Consider how to ‘right size’ your businesses to match reduced demand.

Ensuring a continuity of workforce is key. Some companies are changing work patterns and others have implemented home working. Independent member Philip Smith says “Don’t forget the management! Change how they work to ensure the brain of the business is not suddenly disabled. You should even consider keeping some people away to act as substitutes if key management become unwell or are unable to work.”

Long-term strategy

Where there are ongoing and underlying issues, for a turnaround to take place, a re-growth strategy needs to be put in place. That means finding a way to do things better, cheaper or differently than your competitors, and having a vision that can be turned into a long-term recovery plan.

“Work out what sets you apart from your competitors:

What is different about how you do business?

What is different about how you value your clients and why they would work with you?

What is your Unique Selling Point?”, advises Nina Warwick.

“Coronavirus will continue to test resilience for the immediate future but, with structured planning and a short – and medium – term view, it needn’t prove the end of the road for the UK’s stressed businesses” – Philip Watkins of FRP.

In summary, the key issues to consider are:

- Take stock of the situation and regularly evaluate.

- Maintain or increase the communications flow to key stakeholder.

- Closely manage your cash flow as it’s the lifeblood of the business.

- Ensure your supply chain is resilient and have a contingency plan.

- Adapt your operating model including how senior management work.

- Think about the long-term position and start to put a strategy in place.

The IFT is the key organisation in the UK for professionals advising stressed and distressed businesses on business recovery. We champion turnaround excellence.